83 B Election Form Where To File, Quickly File Your Form 83 B With This Google Doc Template

83 b election form where to file Indeed lately has been sought by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this post I will talk about about 83 B Election Form Where To File.

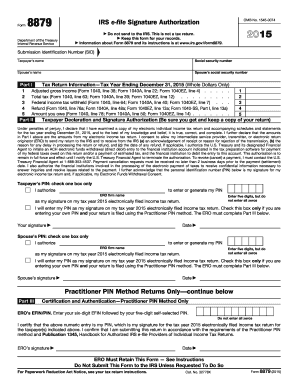

- Form 83b Example Fill Online Printable Fillable Blank Pdffiller

- Stock Options Early Exercise 101

- What And Where Is My 83 B Form

- Https Www Bdo Com Getattachment Ff32bf00 63cb 41e5 A82c 197221a3bf24 Attachment Aspx Cb Tax Alert Taxpayers 83b Pdf

- Always File Your 83 B

- The Tax Effects Of Filing Or Not Filing An 83b Form Business Law Attorneys Fourscore Business Law

Find, Read, And Discover 83 B Election Form Where To File, Such Us:

- What And Where Is My 83 B Form

- Stock Based Compensation Back To Basics

- Profits Interest Grants Basics Dla Piper Accelerate

- 83 B Election Deadline Did Your Client Miss It Here S What To Do Next

- Why Startup Founders Should File 83 B Elections Gust Launch

If you are looking for Local Body Election Voter you've come to the ideal place. We ve got 100 graphics about local body election voter adding pictures, pictures, photos, backgrounds, and more. In these webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

See the chart provided on page 3.

Local body election voter. Complete the irs 83b form that has been provided to you. File at address listed in the forms or instructions. Steps to file your 83b election.

Within the 83b election tab of the exercised option grant a scanned copy of the form can be uploaded for the issuing company. To make an 83b election you must complete the following steps within 30 days of your award date. Sign the 83b election form and letter and follow the instructions in the letter.

If the instructions state to file with the ssa then the form should be filed with the ssa. File form 83b as followsa complete and sign two original copies of the 83b election form sample exhibit d including your spouses signature if you are married in a community property state. Mail the letter and 83b election form to the irs address see dropdown below for address within 30 days after the stock grant there is no relief if you file late.

What is 83b election. File at address listed in the forms or instructions. The 83b election is a provision under the internal revenue code irc that gives an employee or startup founder the option to pay taxes on the total fair market value.

Place for filing returns. You also need to include a cover letter to the irs a template of which can be found here. The signed original 83b election form should be filed with the irs.

Report in turbotax as miscellaneous income as other reportable income. The year in which the election is made. You cant add an attachment to an e filed tax return and the irs accepts only certain forms sent separately and the 83b election isnt one of these.

It is strongly recommended to submit a copy of your signed 83b election form to the issuing company. These section 83b election process examples are right out of the treasury regulations promulgated by the irs. Excise tax place for filing returns.

Example 1 83b election. You pay ordinary income tax of 39600 ie 1000 x 396. Irs filing postmark deadline.

Download the sample 83b election form and letter below. If your lawyer has provided you with 83b election forms you may use those. In this example you timely file a section 83b election within 30 days of the restricted stock grant when your shares are worth 1000.

Choose the file to upload enter the date that you mailed the form to the irs and select save this 83b election. Address it to the irs service center where you file your taxes. B make 4 photocopies of the original signed 83b form two for the irs one for the company for its records and one for yourtaxpayers records.

30 days after date of formation transaction page item 1 instructions 2 irs transmittal letter 3 6 83b election form copy 1 copy 2 copy 3 copy 4 notes an 83b election is necessary only for unvested shares. Here is how to file an 83b election. Mail the completed form to the irs within 30 days of your award date.

More From Local Body Election Voter

- Election In Japan 2020

- Karnataka Election Percentage 2019

- Bihar Election 2020 Date Hindi

- Election By Acclamation Meaning

- Pulire Tamburo Stampante Laser

Incoming Search Terms:

- Save On Capital Gains Taxes With An 83 B Election Pulire Tamburo Stampante Laser,

- Get 25 Lawyer Approved Legal Documents With Incfile S Contract Library Pulire Tamburo Stampante Laser,

- Https Cdn Relayto Com Media Files Bposnqz4shytcegzvzyw 83 B 20election 20form Pdf Pulire Tamburo Stampante Laser,

- How To Issue 83 B Forms To Your Shareholders Shareworks Startup Support Pulire Tamburo Stampante Laser,

- Why Startup Founders Should File 83 B Elections Gust Launch Pulire Tamburo Stampante Laser,

- How To File 83 B Election With The Irs Siskar Co Kevin Siskar Pulire Tamburo Stampante Laser,

/shutterstock_263186492-5bfc2b3246e0fb005144cda3.jpg)