Usa Income Tax Brackets, How Do Marginal Income Tax Rates Work And What If We Increased Them

Usa income tax brackets Indeed recently has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of this post I will discuss about Usa Income Tax Brackets.

- 1

- How Do Federal Income Tax Rates Work Tax Policy Center

- How Do Marginal Income Tax Rates Work And What If We Increased Them

- Who Pays Income Taxes Average Federal Income Tax Rates 2017

- Who Pays Taxes In America In 2019 Itep

- File Us Federal Effective Tax Rates By Income Percentile And Component Gif Wikimedia Commons

Find, Read, And Discover Usa Income Tax Brackets, Such Us:

- Progressivity In United States Income Tax Wikiwand

- Taxtips Ca Ontario Personal Income Tax Rates

- 2014 Federal Income Tax Brackets Nerdwallet

- Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

- How Do Current Tax Rates In The U S Compare To Different Times Throughout Its History Quora

If you re searching for Bc Election 2020 Debate you've come to the perfect location. We have 104 images about bc election 2020 debate adding images, photos, photographs, backgrounds, and more. In such webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

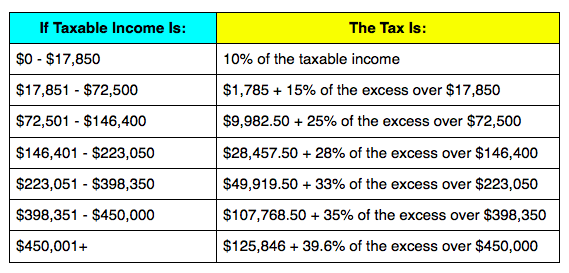

A tax bracket is the range of incomes taxed at given rates which typically differ depending on filing status.

Bc election 2020 debate. Taxpayers can either use the standard deduction or itemize deductions to reduce the amount of taxable income they must pay. The tax code has seven incometax brackets with the lowest tax rate being 10 percent. For married couples filing jointly the same tax rates apply to income brackets ranging from 39410 to 273470.

Generally deductions lower your taxable income by the percentage of your highest federal income tax bracket. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

The income brackets though are adjusted slightly for inflation. The highest earners pay 37 percent. Single filers will pay more than heads of households and there is also a different rate for married couples.

Standard deductions nearly doubled under the tax code overhaul that went. Tax brackets and tax rates for 2020 2021. Taxable income is governed by federal income tax brackets.

Here is a look at what the brackets and tax rates are for 2020 2021. Us tax brackets for 2020 2021 and beyond. O the deduction for federal income tax is limited to 5000 for individuals and 10000 for joint returns in missouri and montana and to 6500 for all filers in oregon.

In november 2019 the irs released the new tax brackets for 2020 2021 with modest changes. Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021. In a progressive individual or corporate income tax system rates rise as income increases.

But there is more to it than that. Income tax brackets and rates. The federal corporate income tax system is flat.

So if you fall into the 22 tax bracket a 1000 deduction could save you 220. 10 12 22 24 32 35 and 37.

More From Bc Election 2020 Debate

- Usa Time Right Now Am Or Pm

- Usa Presidentinvaalit 2020 Vedonlyoenti

- 13th Hunter Chairman Election Arc Episodes

- Mafs Usa Jamie And Doug

- Trump Airlines Cabin

Incoming Search Terms:

- Taxation Trump Airlines Cabin,

- Tax Revenues 15 20 Of Gdp Regardless Of Tax Increases Or Cuts Enjoyment And Contemplation Trump Airlines Cabin,

- Progressivity In United States Income Tax Wikipedia Trump Airlines Cabin,

- How Do Federal Income Tax Rates Work Tax Policy Center Trump Airlines Cabin,

- How Do Current Tax Rates In The U S Compare To Different Times Throughout Its History Quora Trump Airlines Cabin,

- Texas State Tax Chart Trinity Trump Airlines Cabin,