Subsection 453 Election Letter Example, 4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Subsection 453 election letter example Indeed recently is being hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will discuss about Subsection 453 Election Letter Example.

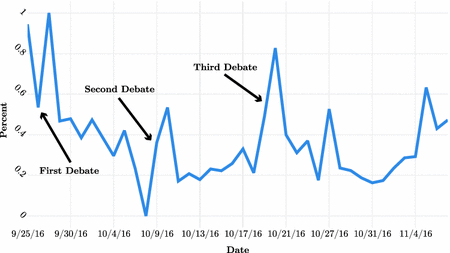

- Event Analysis On The 2016 U S Presidential Election Using Social Media Springerlink

- Tax Implications Of Converting Your Home Into An Income Property Welch Llp

- Https Pub Hamilton Escribemeetings Com Filestream Ashx Documentid 196843

- Http Www Kas De Wf Doc Kas 13979 544 2 30 Pdf

- Https Aceproject Org Main Samples Po Pox M001 Pdf

- Conducting Local Union Officer Elections U S Department Of Labor

Find, Read, And Discover Subsection 453 Election Letter Example, Such Us:

- Release Notes

- 3 13 222 Bmf Entity Unpostable Correction Procedures Internal Revenue Service

- Canada Elections Act

- 2

- National Instrument 45 106 Prospectus Exemptions

If you re looking for Tamburi Frana Logan you've arrived at the perfect place. We have 100 images about tamburi frana logan including images, photos, photographs, backgrounds, and more. In such web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Https Www Aph Gov Au Parliamentary Business Committees House Of Representatives Committees Url Em Elect01 Report Chapter3 Pdf Tamburi Frana Logan

To make this election attach to your income tax and benefit return a letter signed by you.

Tamburi frana logan. You have to make this election by the earliest of the following dates. Paragraphs b and d of the definition of principal residence in section 54 of. The federal 2019 budget includes a provision to allow an owner of a multi unit residential property to make use of the s.

The taxpayer filed a s. Even common rules of thumb such as make the election only if the rate of the price increase is expected to be higher after the change in use than before can lead. An election can be filed under subsection 453.

For example assume a taxpayer rented out their principal residence on june 1 2006 after living in it since 1996 and moved into a friend or relatives home. 452 or 453 elections. My 2017 individual tax return is attached with this letter and it has not been assessed yet.

453 form tax assistance. Whether a taxpayer would be able to file an election under subsection 453 of the act where the taxpayers property was first used as a principal residence then rented and later became a principal residence. The election takes the form of a letter to the cra usually filed with the taxpayers.

However the subsection 453 election which is available when a property that was acquired for gaining or producing income becomes a principal residence is not a slam dunk. Where the taxpayer files an election with the cra then the property is deemed not to have been disposed and taxes are not due until the taxpayer actually sells the property. Election date as of.

Kindly assess my 2017 tax return and accept my 452 election. 90 days after the date the cra asks you to make the election.

More From Tamburi Frana Logan

- Us Election 2018 Results

- Kentucky General Election Ballot

- Nusa Dan Rara Wallpaper Hd

- Ondo Election Today

- Cavan Monaghan Election Candidates 2020 Results

Incoming Search Terms:

- Https Www Canada Ca Content Dam Cra Arc Formspubs Pbg T1079 T1079 Fill 17e Pdf Cavan Monaghan Election Candidates 2020 Results,

- Sec Filing Thomson Reuters Cavan Monaghan Election Candidates 2020 Results,

- 3 13 2 Bmf Account Numbers Internal Revenue Service Cavan Monaghan Election Candidates 2020 Results,

- Https Www Leithwheeler Com Dist Assets Newsletters Planning Matters Principal Residence Exemption Guidelines Pdf Cavan Monaghan Election Candidates 2020 Results,

- Https Governingcouncil Utoronto Ca Media 15484 View Cavan Monaghan Election Candidates 2020 Results,

- 3 13 2 Bmf Account Numbers Internal Revenue Service Cavan Monaghan Election Candidates 2020 Results,