Qsss Election Form, Cbt 100 S Form 2003

Qsss election form Indeed recently has been sought by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this article I will talk about about Qsss Election Form.

- Https Www Tax Ny Gov Pdf Current Forms Ct Ct60 Pdf

- 163 New Jersey Department Of Treasury Forms And Templates Free To Download In Pdf

- Peace For Bangsamoro Dukungan Muhammadiyah Pada Perdamaian Bangsamoro Politics

- 2008 Prentice Hall Inc Ppt Download

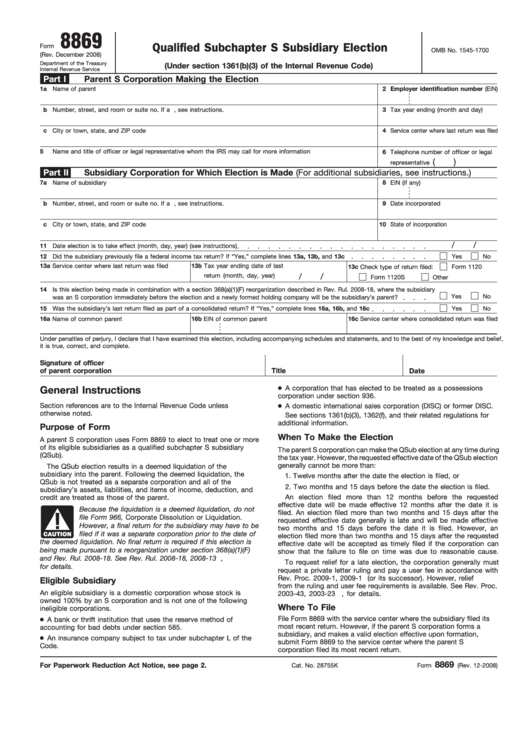

- Fillable Form 8869 Qualified Subchapter S Subsidiary Election Printable Pdf Download

- Http Www Arkansas Gov Dfa Income Tax Documents Ar1103 2004 Pdf

Find, Read, And Discover Qsss Election Form, Such Us:

- Https Www State Nj Us Treasury Taxation Pdf Current Cbt Cbt100sins Pdf

- 2

- 2

- 2

- Https Www State Nj Us Treasury Taxation Pdf Cbt 02100infrm Pdf

If you re searching for Tamburo Sciamanico Prezzo you've arrived at the right location. We have 100 images about tamburo sciamanico prezzo adding pictures, photos, pictures, wallpapers, and more. In these page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

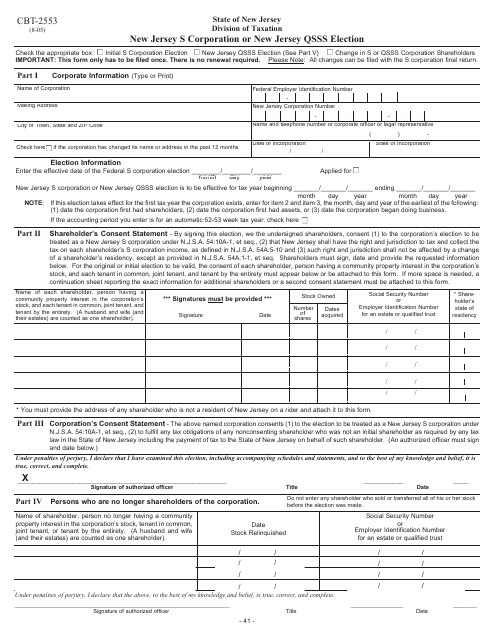

Form Cbt 2553 Download Fillable Pdf Or Fill Online New Jersey S Corporation Or New Jersey Qsss Election New Jersey Templateroller Tamburo Sciamanico Prezzo

All changes can be filed with the s corporation final return.

Tamburo sciamanico prezzo. Is this election being made in combination with a section 368a1f reorganization described rev. However the requested effective date of the qsub election generally cannot be more than 12 months after the date the election is filed or two months and 15 days before the date. There is no renewal requiredplease note.

This form only has to be filed once. When writing a notice of election you may simply the language of the form to ensure that the persons reading it will understand what the form indicates. Qsub elections are made on form 8869 qualified subchapter s subsidiary election.

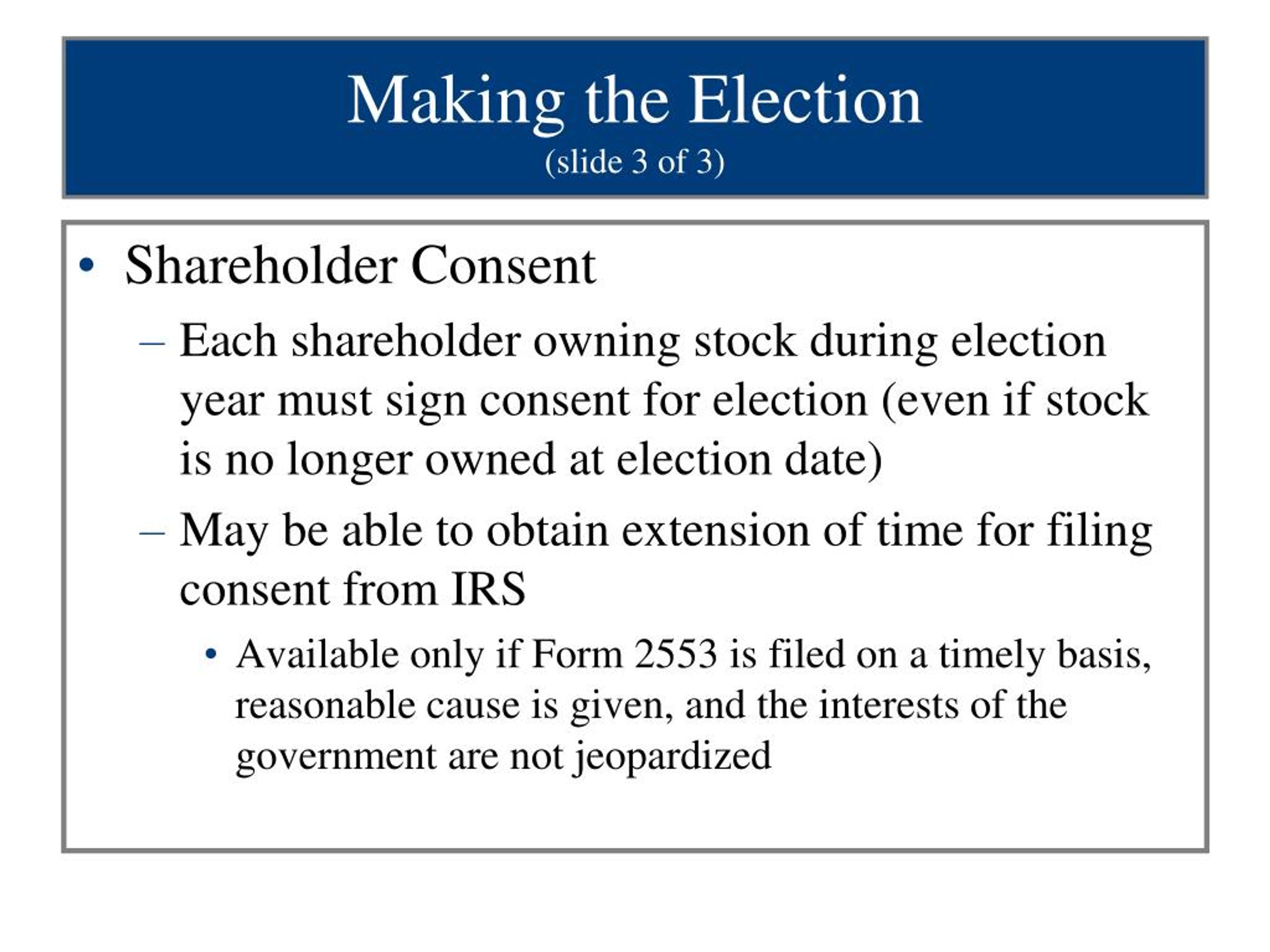

The qsub election results in a deemed liquidation of the subsidiary into the parent. The subsidiary does not file a irs form 2553 because a qsss is not treated as a separate corporation for tax purposes. Making the qsub or qsss election.

A parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary qsub. New jersey s corporation or new jersey qsss election check the appropriate box. This election can be made by completing form ct 60 qsss affiliated entity information schedule and attaching it to your franchise tax return ct 3 ct 3 a ct 3 s ct 32 ct 32 s or ct 32 a.

To be treated as a qsss the parent corporation files irs form 8869 qualified subchapter s subsidiary election pursuant to irc sec. The parent s corporation may make the qsub election at any time during the tax year. The election is effective for the tax year for which the election is made and for all succeeding tax years of the corporation until the election is.

In order to be treated as a qsub or qsss or whatever you want to call the child s corporation the parent s corporation makes a qualified subchapter s subsidiary election using a form 8869 by march 15 of the first year the parent s corporation wants to treat the child s corporation as a qsub. 2008 18 where the subsidiary was an s corporation immediately before the election and a newly formed holding company will be the subsidiarys parent. Election30 if a c corporation elects to be treated as an s corporation and makes a qsub election for its wholly owned subsidiary effec tive the same date the deemed liquidation occurs immediately before the s election while the parent was still a c corporation31 while these rules apply when a parent corporation acquires assets.

An s corporation is permitted to have a wholly owned s corporation subsidiary. That procedure is to remain in effect until the proposed regulations are issued in final form. Irs notice 97 4 provided for a temporary procedure for the election of qsss status through the filing of irs form 966.

Initial s corporation election new jersey qsss election see part v change in s or qsss corporation shareholders important.

More From Tamburo Sciamanico Prezzo

- Hong Kong November Election

- Exit Polls Cartoon

- Election In Delhi 2020 Live

- Httplsgelectionkeralagovinregistration

- Pasta Con Funghi Mazze Di Tamburo

Incoming Search Terms:

- M A Tax Considerations For Buyers And Sellers Pasta Con Funghi Mazze Di Tamburo,

- Fillable Form 8869 Qualified Subchapter S Subsidiary Election Printable Pdf Download Pasta Con Funghi Mazze Di Tamburo,

- S Corporation Questions Answers Pdf Free Download Pasta Con Funghi Mazze Di Tamburo,

- Vol 42 Issue 20 Pasta Con Funghi Mazze Di Tamburo,

- Nyc 8 General Corporation Tax Claim For Credit Or Refund Pasta Con Funghi Mazze Di Tamburo,

- Form 14305vkw7o4j Pasta Con Funghi Mazze Di Tamburo,