Qef Election Meaning, The Trouble With Qef Reporting American Expat Tax Services

Qef election meaning Indeed recently has been sought by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Qef Election Meaning.

- Qef Definition And Synonyms Of Qef In The English Dictionary

- 2

- Http Services Corporate Ir Net Sec Document Service Id P3vybd1hsfiwy0rvdkwyrndhuzuwwlc1cmqybdzzweprtg1odmjtowtim2r1ykc5afpdnxdhseevwvdomgfxoxvqvkjfumlacgnhrm5avdb4twpjme16wtfpq1p6zfdkemfxutlovgm9jnr5cgu9mizmbj1pqusymde4ntuxmdqynei1mjaxodawmtaucgrm

- 2

- Us Tax On Foreign Mutual Fund And Etf Earnings Cb Fi

- International Tax Blog 1291 Pfics

Find, Read, And Discover Qef Election Meaning, Such Us:

- 2

- Https Www Flyleasing Com Media Files F Fly Leasing Documents Tax Information Fly Leasing Pfic Qa Final Pdf

- 2

- Qef Definition And Synonyms Of Qef In The English Dictionary

- The Trouble With Qef Reporting Form 8621 Calculator

If you re looking for Election Day 2020 Jamaica you've reached the perfect place. We have 100 graphics about election day 2020 jamaica adding images, photos, photographs, backgrounds, and much more. In such web page, we additionally have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

The excess distribution rules of irc.

Election day 2020 jamaica. Qualified electing fund qef election. The tax treatment of a qef is better than the other two ways of taxing pfics. If a qualified electing fund qef election is made for a passive foreign investment company pfic and if the pfic receives qualified dividend income qdi can the qef report the qdi to its us.

Internal revenue code of 1986 as amended and the regulations promulgated thereunder collectively the codeif the sponsor determines that the company is a. This election most closely mirrors the us taxation of us mutual funds and allows for capital gains treatment of some of the income as long as any prior 1291 gain has been dealt with. Looking for online definition of qef or what qef stands for.

A so called qualified electing fund or qef election83 iia new mark to market election for marketable pfic securities where gain is taxed annually at ordinary. Qef is listed in the worlds largest and most authoritative dictionary database of abbreviations and acronyms. This is based on the presumption that the company will provide the required information and make the required reporting in order to make a qef election in the first place.

The qef or qualified electing fund election under 1295 is optional method of taxation available for certain pfics. The sponsor shall use commercially reasonable efforts to determine whether in any year the company is deemed to be a passive foreign investment company a pfic within the meaning of us. A qef or qualified electing fund is a pfic for which you have made a special election.

Shareholder elects to treat a pfic as. Shareholders as net capital gain. See the instructions for election a later for information on making this election.

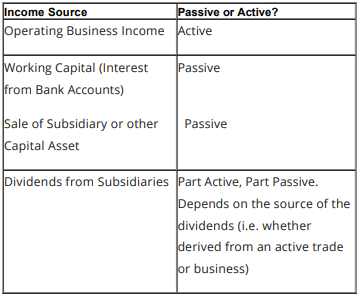

Under the qef rules a pfic is taxed similarly to a partnership meaning that income retains its character capital gains are taxed as capital gains and is passed through to the shareholder for current inclusion in income. Tax issuesthe parties hereto understand and agree that if the company becomes a passive foreign investment company for united states federal income tax purposes shareholders that are deemed united states entities may elect to treat the company as a qualified electing fund qef within the meaning of section 1295 of the internal revenue code. Unfortunately noa qef cannot report qdi that it receives as net capital gain.

But it is anything but that. The qef election must be made by the extended due date of the taxpayers federal income tax return. Many banks investment funds and information material tout a qef election as the easy way out of escaping the default pfic treatment.

A pfic is a qef if a us.

More From Election Day 2020 Jamaica

- Bangladesh Election Commission Exam Questions 2019

- Miss Wahlen Usa Kleinkinder

- Election Night Results Time

- Election Film Download

- Election Form No 7

Incoming Search Terms:

- Https Www Mgiworld Com Media 533825 Mgi White Paper Pfic May2015 Pdf Election Form No 7,

- Pfic What You Need To Know For Compliance New 2020 Election Form No 7,

- Pfic What You Need To Know For Compliance New 2020 Election Form No 7,

- Https Nysba Org App Uploads 2020 03 1221 Letter 1 Pdf Election Form No 7,

- Https Www Reginfo Gov Public Do Downloaddocument Objectid 85798301 Election Form No 7,

- 2 Election Form No 7,