Presidential Election Cycle Theory, What The Us Election And Trump Mean For Wall Street Betashares

Presidential election cycle theory Indeed recently has been sought by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this article I will talk about about Presidential Election Cycle Theory.

- Will The Us Election Cycle Theory Hold Up Advice For Investors Advice For Investors

- Trading The 2016 Election Part 3 Presidential Election Cycle Low Cost Stock Options Trading Advanced Online Stock Trading Lightspeed

- Sick Of 2020 Already Most Voters Aren T Fivethirtyeight

- Wt Wealth Management Presidential Election Cycle Theory

- What 2020 Election Scenarios Mean For Investors

- Gold Presidential Election Cycle Explained Sunshine Profits

Find, Read, And Discover Presidential Election Cycle Theory, Such Us:

- Stock Market Returns Presidential Elections Fidelity

- Presidential Election Process Usagov

- M Axlwyz3cfx9m

- The Presidential Election Cycle Theory Whazzat

- Stock Market Returns Presidential Elections Fidelity

If you re looking for Sample Letter To Election Commission you've come to the right place. We ve got 103 graphics about sample letter to election commission adding pictures, pictures, photos, backgrounds, and more. In such webpage, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

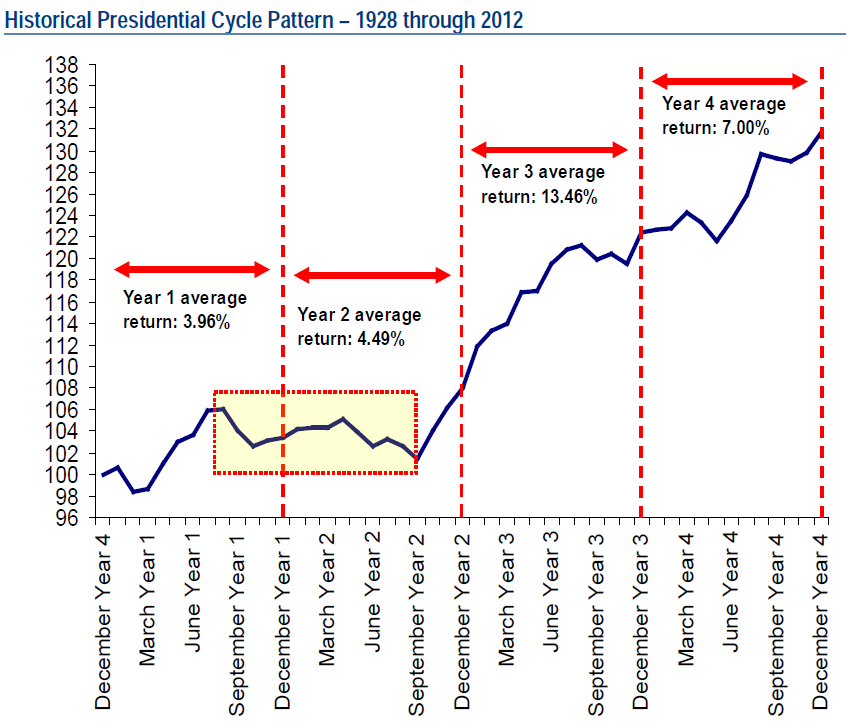

Stock markets are weakest in the year following the election of a new us.

:max_bytes(150000):strip_icc()/spx_vol_median_5day_pre_post-1536x1229-96e04024ee754ec49020784f2fae6f37.jpeg)

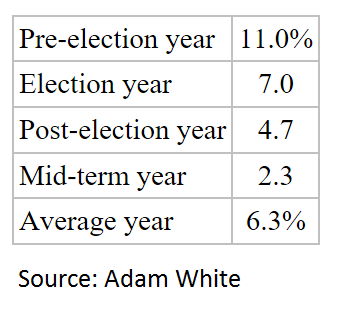

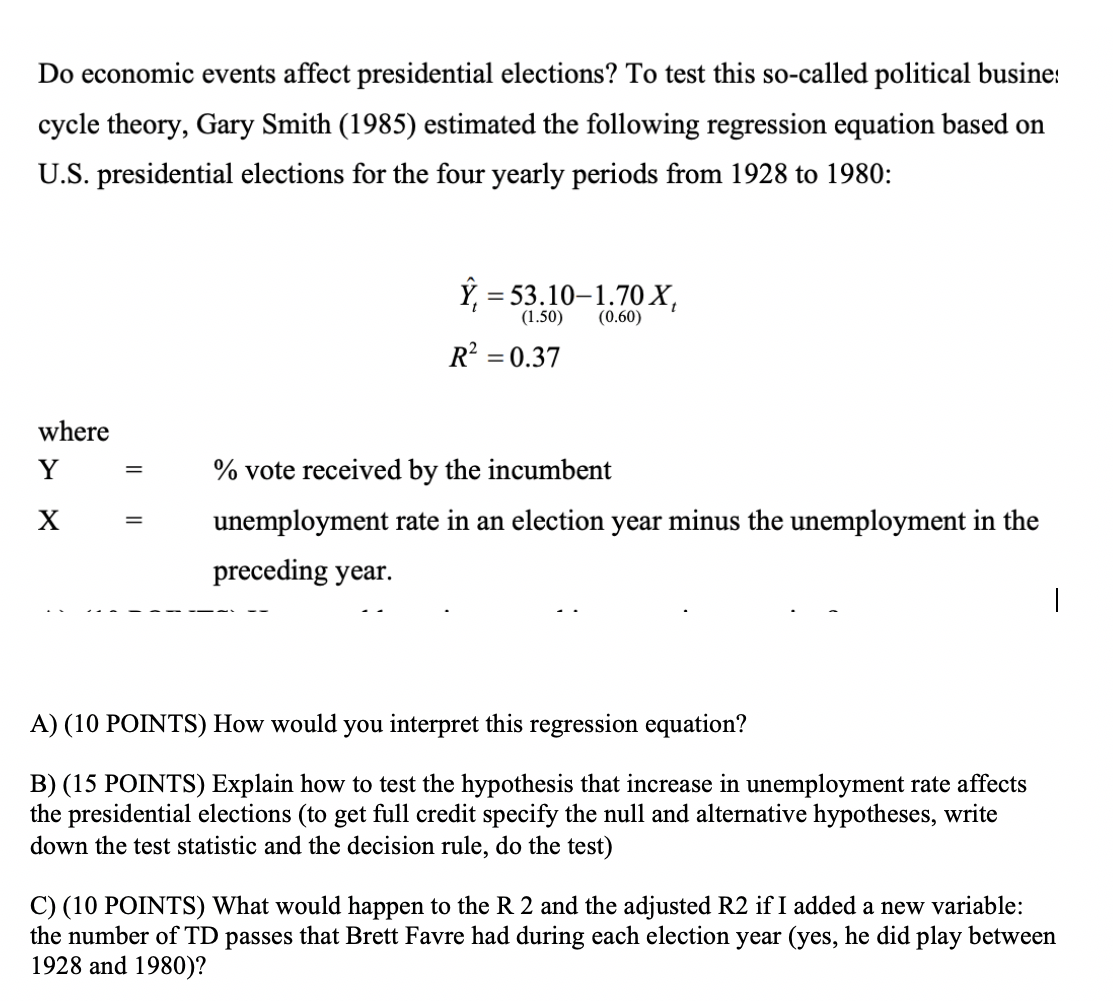

Sample letter to election commission. Election cycle theory its likely more accurate to say that the relationship between the presidents actions or inaction is coincidental when it comes to financial markets. The presidential election cycle theory was developed by yale hirsch who wrote the stock traders almanac published in 1968. Presidential election cycle is a theory related to financial markets and the theory postulates that financial markets for example stock markets exhibit weakening trends following the year of a us.

Us presidential election cycle theory holds that the final years of a presidents term are frequently blessed by prosperity and bull markets as the party in power pursues re election. The presidential election cycle theory developed by stock traders almanac founder yale hirsch contends that us. President and then improve over the remaining three years.

Stock markets are weakest in the year following the election of a new us. The four year united states presidential election cycle is a theory that stock markets are weakest in the year following the election of a new us. The presidential election cycle theory is a theory that predicts the united states stock market after the assumption of office by a new president.

The presidential election cycle theory states that us. What is the presidential election cycle theory. This is the reasoning behind why the stock markets will be at their frailest during.

Amid all the worries and concerns about the global economy and corporate profits some market pundits predict that share prices will finish the year higher than. As developed by a stock market historian yale hirsch this theory maintains that the stock market experiences the sharpest decline in the first year after a new year assumes office. So is 2019s reasonably strong performance to date the result of it also being the third year of a presidential.

It suggests that the presidential election has a predictable impact on americas economic policies and market sentiment irrespective of the specific policies of the president. Stock markets are weakest in the year following the election of a new president. Presidential election cycle theory hasnt held up very well in the past few administrations and in any case its based on averages over more than a century.

And if 2020 has taught us. The theory was propounded by yale hirsch and until mid 1990s.

More From Sample Letter To Election Commission

- Electoral Law Donations

- Election Usa Mode Demploi

- Election In Up India

- Electron Js For Windows

- Polls 2020 Abc

Incoming Search Terms:

- How Presidential Elections Affect The Stock Market Shariaportfolio Polls 2020 Abc,

- Voter Turnout In The United States Presidential Elections Wikipedia Polls 2020 Abc,

- 2008 United States Presidential Election Wikipedia Polls 2020 Abc,

- Traders Prepare For U S Presidential Election Cycle Theory As Votes Begin Polls 2020 Abc,

- Solved Do Economic Events Affect Presidential Elections Chegg Com Polls 2020 Abc,

- Electoral Maths Presidential Elections And The S P 500 Ft Alphaville Polls 2020 Abc,

:max_bytes(150000):strip_icc()/10.30.20-f79c3db4945a44a38c44df2ad3ea9c0f.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/TimingMktPresidentialElectionYear_GettyImages-1224201202-1e4576f7c8d447b1abd0df304fb8ed88.jpg)