New York Qsub Election, 3 13 222 Bmf Entity Unpostable Correction Procedures Internal Revenue Service

New york qsub election Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this post I will talk about about New York Qsub Election.

- M A Tax For 2019

- Https Www Tax Ny Gov Pdf 2011 Corp Ct60qsss 2011 Pdf

- 3 13 2 Bmf Account Numbers Internal Revenue Service

- Irs 8869 2017 Fill And Sign Printable Template Online Us Legal Forms

- Https Www Irs Gov Pub Irs Drop Rp 17 30 Pdf

- State And Local Considerations In Using An F Reorganization To Facilitate An Acquisition

Find, Read, And Discover New York Qsub Election, Such Us:

- 2

- Https Checkpointlearning Thomsonreuters Com Courses Filedownload Courseidhiddenfield 2596 Deliveryformatidhiddenfield 5

- Forming A Business Tax Considerations

- 3 13 222 Bmf Entity Unpostable Correction Procedures Internal Revenue Service

- Https Www Irs Gov Pub Irs Drop Rp 11 14 Pdf

If you are looking for Election Movie Johnnie To you've arrived at the ideal location. We ve got 100 images about election movie johnnie to including images, photos, pictures, wallpapers, and more. In such web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

However a qsub election can only be made when the electing parent corporation is an s corporation.

Election movie johnnie to. The parent and subsidiary will be taxed as a single new york s corporation and the shareholders of parent will be taxed under the article 22 personal income tax. Once a valid qsub election is made the subsidiary is deemed to have been liquidated into its s corporation parent tax free under irc section 332 and would not be treated as a separate corporation for any other income tax purposes. A subsequent sale of the qsub for 1 million would result in a 900000 gain which is the same result as if the assets had never been transferred to the subsidiary.

In both instances parent and subsidiary will be taxed as a single new york c corporation under article 9 a or article 32 and the shareholders of the parent. Also arkansas79 new jersey80 new york81 and pennsylvania82 re quire a separate state law election for corporations desiring to be treated as s corporations. Qsub elections can be effective any time during the year and thus a qsub election in the simple example above could be made at any time through december 31 2000 and qualify for transitional relief.

Because of the qsub election. The childs subchapter s status gets terminated because an s corporation is not a eligible subchapter s corporation shareholder. 10 the 100000 asset basis is retained.

Subchapter s election also recognize the federal qsub election a limited number of states require a qsub to make a separate state election see eg new jersey and new york a number of states are silent regarding treatment of a qsub 20. A quick tangential point. Y is treated as a new corporation acquiring all of its assets and assuming all of its liabilities immediately before the revocation from its s corporation parent in a deemed exchange for y stock.

If an s corporation acquires another s corporation and does not make the qsub election for the new child that child becomes a regular c corporation. New york will follow the federal qsss treatment a if the subsidiary is a new york taxpayer or b if the subsidiary is not a taxpayer but the parent makes a qsss inclusion election. New york will follow the federal qsss treatment where the subsidiary is a new york taxpayer but the parent is not if the parent makes the new york s election.

If however the llc conversion occurs long after the contribution of target stock to newco the transaction does not qualify as an f reorganization and a valid qsub election is essential to avoid potential risks associated with momentary. X an s corporation owns 100 percent of the stock of y a corporation for which a qsub election is in effect. X subsequently revokes the qsub election.

More From Election Movie Johnnie To

- Tipperary Election Candidates 2020 Wiki

- Election 2020 Results Sri Lanka Seats

- Election 2020 Key Dates

- 2020 Election Ballot Washington State

- Asciugatura A Tamburo O Centrifuga

Incoming Search Terms:

- 2019 Nyc Elections Ranked Choice Voting Passes Asciugatura A Tamburo O Centrifuga,

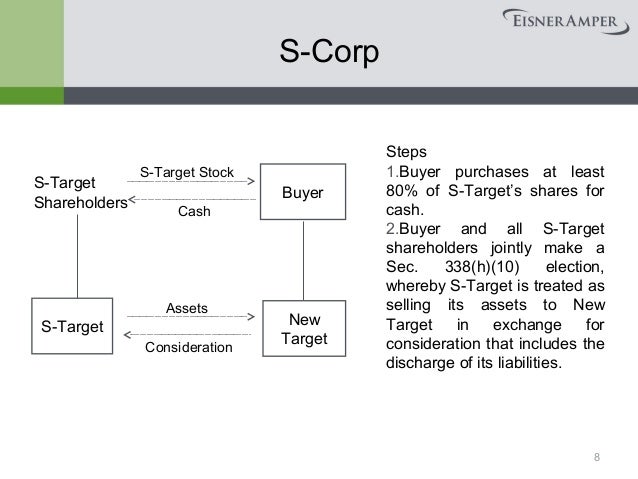

- 338h10 Elections V10 31 16 Asciugatura A Tamburo O Centrifuga,

- Http Www Rasmusen Org Citigroup File 20stamped 20affirmation 20with 20exhibits Pdf Asciugatura A Tamburo O Centrifuga,

- Http Www Rasmusen Org Citigroup File 20stamped 20affirmation 20with 20exhibits Pdf Asciugatura A Tamburo O Centrifuga,

- Https Www Irs Gov Pub Irs Drop Rp 11 14 Pdf Asciugatura A Tamburo O Centrifuga,

- 3 13 222 Bmf Entity Unpostable Correction Procedures Internal Revenue Service Asciugatura A Tamburo O Centrifuga,