Election To Expense Small Equipment, Igtiq5uv0 Itlm

Election to expense small equipment Indeed recently is being sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this article I will talk about about Election To Expense Small Equipment.

- How Small Businesses Write Off Equipment Purchases Coastal Tax Advisors

- Instructions For Form 2106 2019 Internal Revenue Service

- Deducting Business Expenses Which Expenses Are Tax Deductible

- Review Administration History

- The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

- Five Types Of Interest Expense Three Sets Of New Rules

Find, Read, And Discover Election To Expense Small Equipment, Such Us:

- Guide To Residential Real Estate Deductions For 2018

- Dutsuqwijqv3pm

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrkz7vbtnfkabw1oezzw57uz B8svuun 5knuhra5qd2jqismpj Usqp Cau

- Hacked In 7 Minutes Questions Of Vulnerability Surround New Jersey S Aging Voting Machines Community News

- 2

If you are searching for Us Presidential Election 2020 New Hampshire you've come to the right place. We have 104 graphics about us presidential election 2020 new hampshire adding images, photos, photographs, wallpapers, and more. In these page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

How The De Minimis Safe Harbor Election Can Benefit Your Business Us Presidential Election 2020 New Hampshire

Rather the expense is spread out over the life of the equipment.

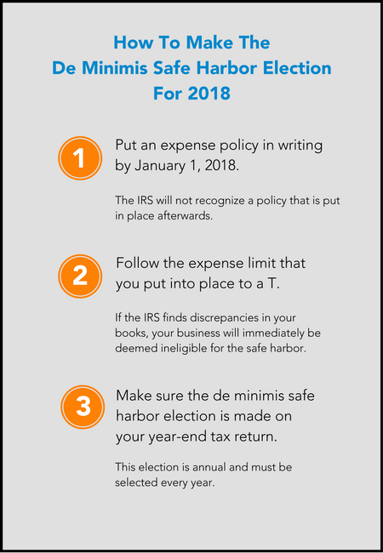

Us presidential election 2020 new hampshire. There is also a safe harbor for business expenses. You get a full deduction for the cost of equipment in the first year. It lets you deduct your items as expenses instead of depreciating them over the life of the item.

For example if you spend 30000 on a machine you might write off 10000 for three years. That means you no longer have to capitalize and depreciate anything you buy for your business computer furniture etc over time so long as each individual item costs less than 2500. The policy must specify the treatment of expenditure for non tax purposes as an expense for property costing less than a specified dollar amount or that has a useful life of less than 12 months.

This is mostly larger businesses. From an accounting standpoint equipment is considered capital assets or fixed assets which are used by the business to make a profit. Well if you buy a lot of low cost items using the de minims safe harbor rule simplifies recordkeeping considerably.

This is called depreciation. Prior to 2016 it was 500 but since then it is 2500. We will then add the safe harbor election for small taxpayers section 1263a 3h form to your tax return with the description of your property.

If your business files applicable financial statements then you can make an annual election to expense property and equipment purchases costing 5000 or less per invoice or per item on the invoice. Similar to the safe harbor election section 179 allows businesses to deduct the full amount of an expense for equipment or software. 500 de minimis threshold.

9734 amended section generally changing its content from provisions that formerly made available an additional first year depreciation allowance for small businesses to provisions allowing a taxpayer to elect to treat the cost of section 179 property as an expense which is not chargeable to capital account with any cost so. For example say you own a small motel and buy a new iron costing 25 costs for hotelmotel use irons range from about 9 to 40 for each of your 40 rooms. The irs set up section 179 deductions to help businesses by allowing them to take a depreciation deduction for certain business assetslike machinery equipment and vehiclesin the first year these assets are placed in service.

The purchase of equipment is not accounted for as an expense in one year. The concept of depreciation for an asset is to spread the cost of using the asset over a number of years the assets useful life by taking a tax deduction for. Usually when you buy equipment you have to write the expense off over time.

Finally an election must be made on your tax return to inform the irs that you will be making the safe harbor election thats our job.

More From Us Presidential Election 2020 New Hampshire

- Election Day Emoji

- New York Election Ocasio Cortez

- Election Movie Gross Earnings

- Electron Js Shell

- Election News Channel

Incoming Search Terms:

- 2 Election News Channel,

- Ffmcarl Ly68cm Election News Channel,

- 2 Election News Channel,

- Lok Sabha Elections 2019 Why India S Election Is Among The World S Most Expensive Election News Channel,

- With Major Contracts Ahead Of 2020 Voting Machine Industry Comes Under Scrutiny Npr Election News Channel,

- Maryland Election Chief State Needs 20m More To Pull Off Nov 3 Election In A Pandemic Baltimore Sun Election News Channel,