Election Meaning Tax, The Generation Skipping Transfer Tax A Quick Guide

Election meaning tax Indeed lately is being sought by users around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of this article I will discuss about Election Meaning Tax.

- 2

- A Brave New World Uk Real Estate Funds And The New Non Resident Capital Gains Tax On Uk Land Osborne Clarke Osborne Clarke

- Wichita Falls Tx Official Website

- Http Www Bradfordtaxinstitute Com Endnotes Prop Reg 1 1400z 2a 1c2iii Pdf

- Income Tax Comparison Of New Income Tax Regime With Old Tax Regime The Economic Times

- Poll Taxes National Museum Of American History

Find, Read, And Discover Election Meaning Tax, Such Us:

- Income Tax Comparison Of New Income Tax Regime With Old Tax Regime The Economic Times

- What Election Tax Promises Will Mean For Your Wallet

- Https Www Itbstevetowers Com Wp Content Uploads 2019 06 Malta Pdf

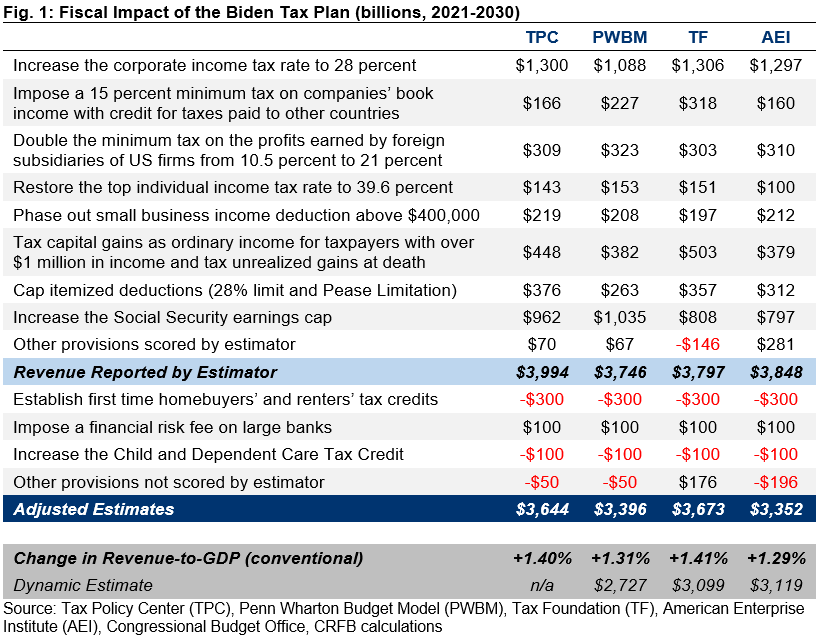

- What Trump And Biden Tax Policies Could Mean For Your Paycheck Tax Return Investments And Retirement Savings Marketwatch

- Election 2020 President Trump S Tax Plans Kiplinger

If you re looking for 1994 Presidential Election Sri Lanka you've come to the right location. We ve got 104 images about 1994 presidential election sri lanka adding pictures, pictures, photos, backgrounds, and more. In these webpage, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

There are many of them pertaining to hundreds of different events.

1994 presidential election sri lanka. For example a business can elect to be taxed as a c corporation or an s corporation. Another example is to keep the accounting records under the cash. That means that the law gives you a choice on how to treat certain tax items.

On the latest episode of willis weighs in benjamin willis contributing editor for tax notes federal and victor fleischer professor at university of california irvine school of law and former. A claim or election should be made in or accompany your company tax return because the claim or election may affect your corporation tax calculations and how much tax you have to pay. First when an employee decides to make an election the election must be filed with the irs no later than 30 days after the date the property was transferred.

Whether in a stimulus package or a post election tax act the democratic caucus is looking to remove the salt limitation in the tax cut and jobs act. A tax election is a choice made by a taxpayer among several possible options for how to deal with a situation from a tax reporting perspective. There are certain elections you can make when preparing a tax return.

8 2018 to mean that only vat exempt persons or those whose gross annual sales or receipts do not exceed the p3 million threshold and thus are covered by the three percent opt imposed by section 116 of the tax code as amended can make the eight percent tax electionaccordingly the implementing regulations cited that the following persons cannot avail of the eight percent tax option. As certain states are desperately looking for revenue to offset the covid 19 pandemic the possibility of states raising tax rates is much more likely. For example in order to be.

The 83b election is an irc provision giving an employee or founder the option to pay taxes upfront on the fair market value of restricted equity.

Https Www Revenue Ie En Tax Professionals Tdm Pensions D Appendix3 20180810114729 Pdf 1994 Presidential Election Sri Lanka

More From 1994 Presidential Election Sri Lanka

- Election 2020 How To Vote

- Election Night Coverage 2016 Msnbc

- Bc Election 2020 Ridings Map

- Election Id Form 4

- Election President Du Senat En Rdc

Incoming Search Terms:

- 1 Election President Du Senat En Rdc,

- Join Now Exit Tax Club Revocation Of Election Illegal Taxation Roe Meaning Election President Du Senat En Rdc,

- Krpkd5ygm4xsgm Election President Du Senat En Rdc,

- Restricted Stock Units Rsus Facts Election President Du Senat En Rdc,

- California Propositions Results For 2020 Ballot Measures On Rent Control Property Taxes Criminal Justice Reform And More Abc7 San Francisco Election President Du Senat En Rdc,

- Gt S Quick Guide To Section 338 H 10 Elections Insights Greenberg Traurig Llp Election President Du Senat En Rdc,

:max_bytes(150000):strip_icc()/Screenshot34-2c14034ead494014a0b1d629b1015dd3.png)