Election Form Excess Non Concessional Contributions, Ben Symons Barrister State Chambers July Ppt Download

Election form excess non concessional contributions Indeed lately is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this post I will talk about about Election Form Excess Non Concessional Contributions.

- Http Opac Uma Ac Id Repository Neoliberalisme Pdf

- Super Contributions New Rules And Key Issues For June 30

- Https Pds Hostplus Com Au Media Files Hostplus Hostplus Member Guide Pdf Generation Hostplus Member Guide Section7 Pdf La En Hash 7384a135cd1458e302150006310435c0

- Excess Contributions Tax The Good News Continues Leading Smsf Law Firm

- Https Www Nab Com Au Content Dam Nabrwd Documents Fact Sheets Superannuation Non Concessional Contributions Pdf Pdf

- Sri Lanka Staff Report For The 2001 Article Iv Consultation And Request For Stand By Arrangement Sri Lanka Staff Report For The 2001 Article Iv Consultation And Request For Stand By Arrangement

Find, Read, And Discover Election Form Excess Non Concessional Contributions, Such Us:

- Smsf Association Superannuation Reference Guide Downloadable Pdf

- Oecd Ilibrary Home

- Technical Bulletin

- Https Www Idx Co Id Staticdata Newsandannouncement Announcementstock From Erep 202002 F862f97b98 3c3ca65cfa Pdf

- 2

If you re searching for Presidential Election 2020 For Kids you've reached the right location. We have 100 images about presidential election 2020 for kids adding pictures, photos, photographs, backgrounds, and more. In such page, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Bosnia And Herzegovina Bosnia And Herzegovina Staff Report For The First Review Under The Stand By Arrangement Presidential Election 2020 For Kids

No excess non concessional contributions were able to be released from super funds.

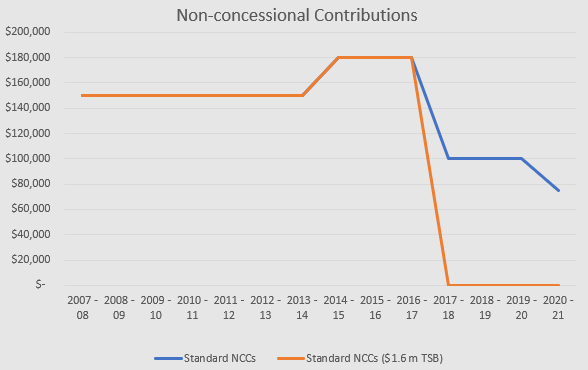

Presidential election 2020 for kids. Excess non concessional contributions were introduced from 1 july 2007 whereby 100 per cent of excess non concessional contributions were taxed at the top marginal rate. If you have a total super balance in excess of the transfer balance cap applicable at 30 june of the previous financial year 16 million as at 1 july 2017 subject to. After the commissioner authorises the release of the 2000 from her accumulation account she will be liable for an excess non concessional contributions tax of over 7000.

If you are not already registered go to online services to register. Form of a release authority issued by the ato to withdraw the excess amount from their superannuation fund. Marginal rate plus medicare levy.

There are non concessional contribution caps age limits and potential excess non concessional contributions tax. The amount of excess non concessional contributions as. Ato will send a release authority to the super funds nominated by the member.

For most people it is easier and quicker to log into mygov external link to complete the excess non concessional contributions election form. However if you do it will help us identify the member correctly and process your report quickly. This contribution will be counted towards your non concessional contributions cap for the financial year in which the contribution is made.

When a member completes the excess non concessional contributions election form. Non concessional contributions are generally made from personal bank account savings. How to order a paper copy.

They pay an amount to the ato in total equal to their excess non concessional contributions amounts and 85 of the associated earnings amount from 1 july 2018 super funds have ten. Excess non concessional contributions election form complete the form online. Along with the excess contributions the election by the individual will include 85 of the associated earnings amount.

A non concessional contribution is a contribution made to superannuation with after tax savings. All of which is discussed below. To my mind the imposition of a tax of over 7000 on income of 900 when a tax payer has acted in good faith does not meet the intended purpose of the new laws.

Alternatively the member may elect. Excess nonconcessional contributions election form section a.

Super Contributions Too Much Super Can Mean Extra Tax Introduction Pdf Free Download Presidential Election 2020 For Kids

More From Presidential Election 2020 For Kids

- Electron Js Windows App

- Election Hong Kong Movie Review

- Trump Vs Biden Debate Political Cartoon

- Electoral Law Postal Votes

- Election Arc Hunter Hunter

Incoming Search Terms:

- Https Www Gpb Com Au S Taxrates2019 Pdf Election Arc Hunter Hunter,

- Super Contributions Too Much Super Can Mean Extra Tax Introduction Pdf Free Download Election Arc Hunter Hunter,

- Winners And Losers From The Government S Compromise On Superannuation Election Arc Hunter Hunter,

- Https Www Ato Gov Au Uploadedfiles Content Spr Downloads 20180622 20n74824 06 2018 C047 00001 Encc 20paper 20ef 20 Pdf Election Arc Hunter Hunter,

- 2014 Australian Post Budget Presentation Election Arc Hunter Hunter,

- Financial Planning In Australia Ppt Download Election Arc Hunter Hunter,